Written By - David Bruton

Introduction

When it comes to foreign direct investment (FDI), Ireland was the number one choice for US Tech companies in 2021. The accumulated value of foreign direct investment in Ireland rose to over €1 trillion in 2019, according to a new analysis from the Central Statistics Office. The US remains the biggest source of FDI in Ireland. In 2019, this stood at just over €700 billion or 71.6%. The second highest was Bermuda at €34.1 billion. IBM was the first US Tech company to set up in Ireland in 1956. Since then companies such as Google, Microsoft, Intel, Apple and Facebook have all set up operations in Ireland. The presence of such tech titans in Ireland has resulted in other US Tech companies following suit.

Ireland, though small in land size and population, ranks among the richest nations globally. In 2023, its GDP per capita reached $104,270, as reported by the IMF, placing it just behind Luxembourg and exceeding that of the U.S., Switzerland, Singapore, and Norway. Additionally, it is one of the fastest-expanding economies, with GDP growth rates of 15.1 percent in 2023 and 9.1 percent in 2022.

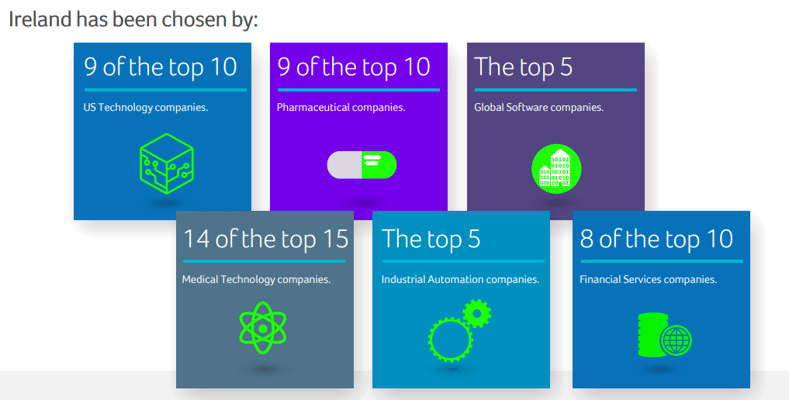

At present Ireland has the following:

-

9 of the top 10 global software companies

-

9 of the top 10 US technology companies

-

The top 3 enterprise software companies

-

4 of the top 5 IT services companies

Coming in 2nd place as a destination for FDI in the UK. To date $51.1 billion has been invested in the UK through FDI.

3rd place for FDI investment went to The Netherlands, with a figure of $33.8 billion invested to date.

The business relationship between the US and Ireland is experiencing unprecedented growth and investment. You may have a question, how many US companies are there in Ireland in 2024? Currently, 970 US companies in Ireland employ 378,000 people directly and indirectly, contributing over €41 billion to the Irish economy annually. Conversely, Ireland stands as the 9th largest source of FDI to the US, with 500 Irish companies employing nearly 100,000 people across all 50 states.

For a complete list of companies in Ireland, you can check here.

Tech companies that have chosen Ireland

The first US Tech company to invest in Ireland was IBM when it opened its Dublin office in 1956. Then Ericsson invested in Ireland in 1957. The 1970s saw the arrival of Hewlett Packard, followed by Microsoft, Dell, Oracle, and Intel in the 1980s. The 1990s saw more FDI investment in Ireland with the arrival of Symantec, Fidelity, SAP, and Pilz. In 2000 Google, Yahoo, Sita, Amazon, eBay, Cisco, Aon, Facebook, Workday, Mastercard, and Citi set up Ireland operations.

Ireland has several factors that make it an attractive destination for US Tech companies. These include its membership in the European Union, its low corporate tax rate, its educated workforce and its good market access. Ireland's membership in the European Union means that US companies can trade freely with Ireland and have easy access to the European market. Ireland's low corporate tax rate of 12.5% is another major factor that attracts US companies. This is significantly lower than the US corporate tax rate of 35%. Ireland's educated workforce is also a key attraction for US companies.

Ireland has been successful in attracting US companies in a number of different sectors. These include pharmaceuticals, medical devices, ICT and clean tech. Ireland is the world's largest exporter of pharmaceuticals and medical devices. Irish-based companies such as Pfizer, Johnson & Johnson and Boston Scientific are among the world's leading exporters in these sectors. Ireland is also a world leader in ICT.

Irish companies such as Google, Facebook and LinkedIn are at the forefront of the global ICT sector. Ireland is also a leading destination for clean tech investment. US companies such as General Electric and Bloomberg have invested heavily in Ireland's clean tech sector.

In addition to the thriving tech industry, Ireland also hosts some of the world's largest pharmaceutical, medical, and biotechnology companies. To know more on the list of pharma and other sector companies in Ireland, check here.

Why do Tech companies choose Ireland?

For US companies, there are so many benefits of moving to Ireland. Some of the reasons include:

Average Return on Investment

To start, the average return on investment for the companies that have invested in Ireland was the 5th highest in Europe, coming in at 11.7%. Ireland remains committed to increasing investment in productive capital assets, including key infrastructure.

Corporation tax - 12.5%

The corporation tax rate of 12.5% is undoubtedly an attraction to US and UK companies looking to move to Ireland. However, this is not the only incentive. Ireland has been ranked 1st in Europe for ease of paying taxes as per PwC "Paying Taxes 2020" report. There is a whole lot of other benefits that include R&D tax credit at 25% for qualifying R&D expenditure and an extensive tax treaty network.

Educated population

Ireland has a 98% participation rate in education among 18-year-olds (highest in Europe). The Irish Education System is ranked 6th best in the world. Computer science and coding are now secondary/high school subjects.

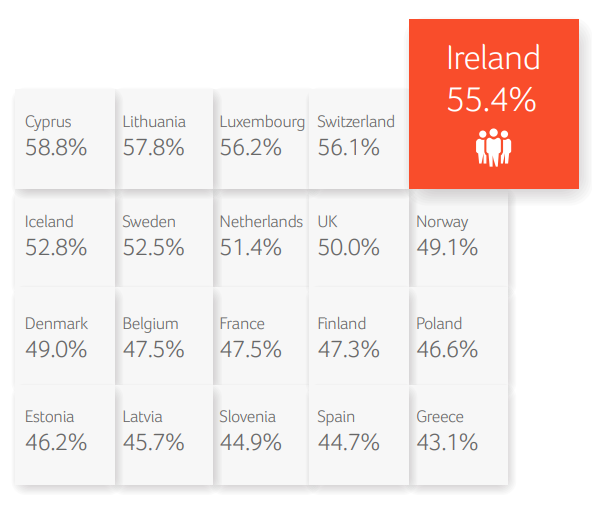

Ireland has been ranked 11th globally for meeting the needs of a competitive economy with a strong reputation for producing high-quality graduates. Ireland’s highly educated population has been a key driver of economic success (3rd level attainment among ages 30-34 of 55.4% vs EU average 40.3%). Source: Eurostat, 2020; IMD World Competitiveness Yearbook, 2020.

The pipeline of highly educated graduates remains strong (228,000 students enrolled in 3rd level education in 2018/19). There have been tremendous ongoing efforts to drive participation for STEM applicants to support a knowledge-intensive economy.

Are you looking to register or move your company's European operations to Ireland? We can help.

Connected research

The Irish government has invested over $700 million in Research & Development (R&D). Ireland has a high level of collaboration between industry, academia, state agencies and regulatory authorities. Ireland ranked among the top 10 most innovative EU countries. Ireland also ranks among the top 15 most innovative countries in the world, including 1st for knowledge diffusion.

Ireland’s dynamic R&D sector is driven by an exceptional level of collaboration between industry, academia, state agencies and regulatory authorities.

Research Priority Areas 2018-2023, Ireland’s strategy for R&D, science and technology sets out priority areas across 6 themes. Source: European Innovation Scoreboard 2020; Global Innovation Index 2020; SFI Annual Report, 2019; DBEI, 2019.

Strong talent pool

Ireland is number 1 in the world for attracting and retaining talent according to the IMD Yearbook 2017. Ireland also has the youngest population in Europe, with one-third of the population under 25 years of age and nearly half the population under the age of 34. Nearly 10 per cent of workers based in Dublin work as software developers, according to Stack Overflow Report 2017.

Despite Brexit, British citizens can continue to work, live and study in Ireland. Nathan Trust works closely with competent authorities on applying for employment permits and visas for workers from outside of the EU. There is one condition here for the critical skills application process. Please note that you will be required to have a ratio of 1:1 for non-EU employees to EU employees. For example, if you plan to get a work permit for one non-EU employee, you should have at least 1 EU-based employee on the payroll. A part-time employee will be acceptable. We can help you source a part-time employee should you require assistance.

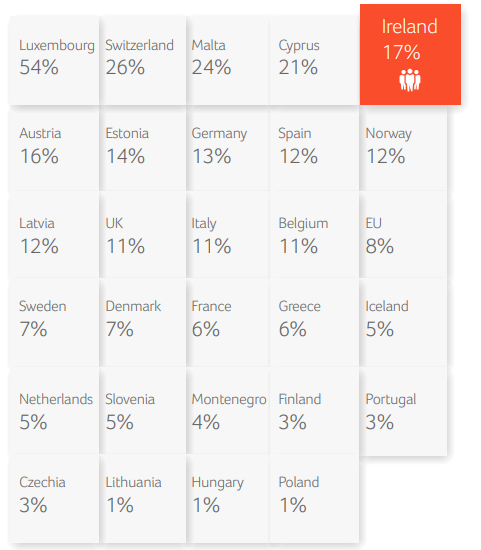

The continued success of Ireland’s FDI has resulted in a cluster effect for businesses as well as employees. This has resulted in Ireland having the fastest-growing tech worker population in Europe for 2017. The international share of the workforce is the 4th highest in the EU (17% in 2019). Source: CSO Labour Force Survey, Q3 2020; Eurostat, 2020.

Market access

One of the primary reasons companies look to invest outside their home markets is to gain access to new markets. A report from the Economist Intelligence Unit found that 58 per cent of respondents emphasised market access as one of their top three motivations for setting up international operations.

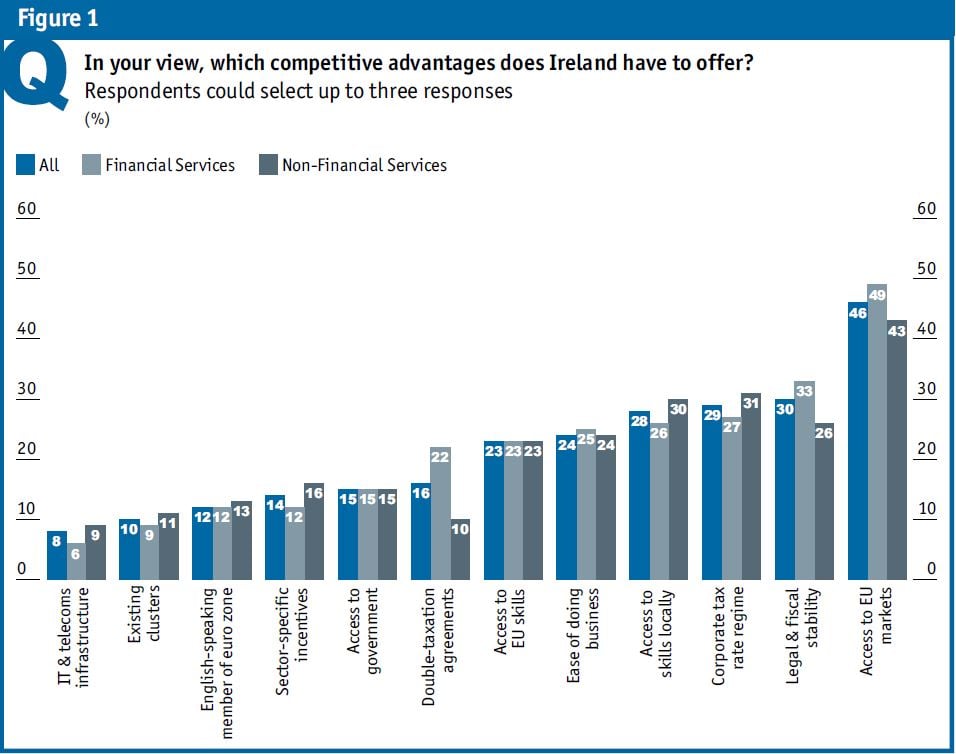

When asked about Ireland’s main competitive advantages, the report shows that the country's access to European markets was top of the list. 46% of respondents highlighted market access, much more than any other factor.

(see below graph/Figure 1).

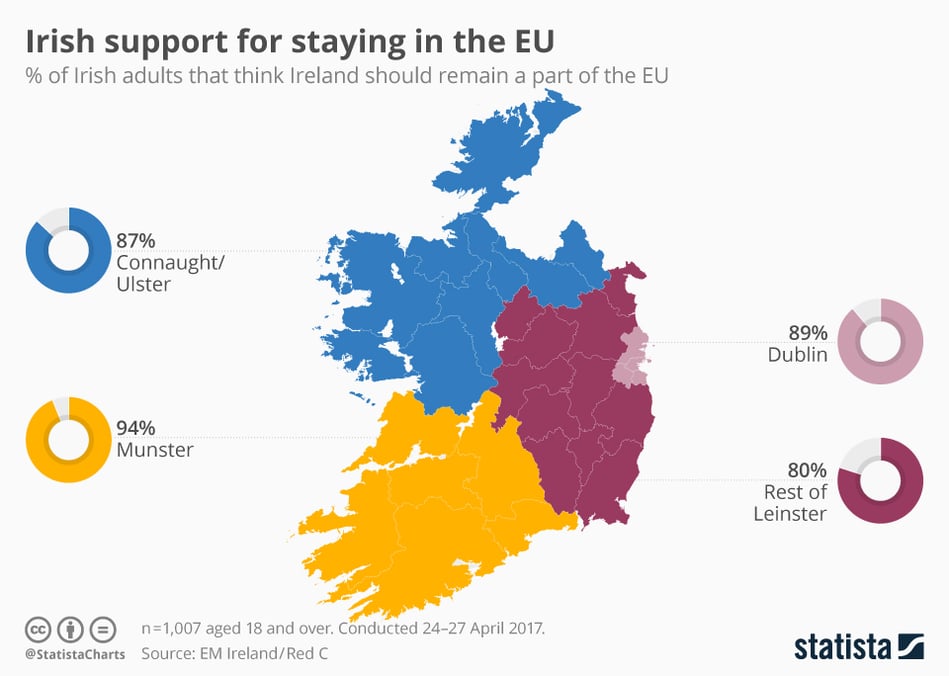

Ireland is pro-EU

-

Ireland will remain a core member of the EU single market & Euro currency

-

Ireland is the only English-speaking country in the Eurozone, post-Brexit

-

Ireland is most positive about the EU. 86% are in favour of the free movement of EU citizens to live, work, study, and do business in the EU (EU average 81%)

-

The international share of the total population is one of the highest in the EU (12.9% in 2020). There were over 400,000 international workers in the labour force in Q4 2020.

Ireland is one of the best countries for Global Expansion in 2024.

If you are thinking of setting up a company in Ireland you can contact us using the form below:

%20copy.jpg)

.svg)