WHAT ARE THE KEY STEPS INVOLVED IN SETTING UP A COMPANY IN IRELAND?

Starting a business in Ireland is an exciting milestone. Whether you’re launching a startup, transitioning from a sole trader, or expanding your operations, incorporating a limited company not only provides access to a thriving economy but also unlocks numerous tax advantages for your Irish company. By adhering to the legal requirements, you can position your business for long-term success.

Setting up a limited company in Ireland from the US, UK, or any other country outside Ireland involves several key stages, from selecting the right business structure to completing registration with the relevant authorities. With our company's expert team guiding you through every step, the process becomes simple and efficient.

Below are the most important key steps for setting up a company in Ireland:

1. Choose Your Company Structure:

Whether you're an overseas entrepreneur, a growing startup, or an established business looking to expand, Ireland offers several business structures to align with your goals.

The Private Limited Company (LTD) offers flexibility and liability protection with minimal requirements, making it ideal for most businesses. Partnerships are simpler but offer less protection, while PLCS suit larger enterprises planning public trading.

If it's your first time setting up a company, these options can seem overwhelming. But don't panic, this is why you have experts like us to help you in every step.

2. Choose A Company Name:

You can select a unique name for your company and verify its availability with the CRO's company name search facility. This is a crucial step in the Irish company registration process.

3. Set the Registered Address For Your New Limited Company:

Please ensure you have an official address in Ireland to receive documents related to your company. Nathan Trust can provide an official registered address in Cork or Dublin.

4. Identify and Appoint Directors and Shareholders:

Identify who will serve as the directors and shareholders of the company. You will need at least one Irish resident director and one shareholder. If you don’t have an Irish resident director, you can apply for a Non-EEA Directors' bond.

A shareholder can be an individual or a company that owns one or more shares. We recommend authorising 100,000 shares and issuing 100 shares of €1 each to reflect ownership. To learn more about authorised and issued shared capital, read this article. Nathan Trust can guide you through share structuring and capital planning with expert support.

5. Appoint A Company Secretary:

Appoint a company secretary responsible for upholding compliance with company law and maintaining the company seal.

6. Memorandum and Articles of Association:

Prepare and register the company's constitution, including the memorandum and articles of association, with the CRO. These are essential incorporation documents.

7. Tax Registration:

Register your company for tax purposes with the Revenue Commissioners through the Revenue Online Service (ROS).

8. Employer Registration:

If you intend to hire employees, register as an employer with Revenue.

This step is crucial for managing your director's income tax return as well.

9. Bank Account:

Open an Irish business bank account for your company. At Nathan Trust, we have helped hundreds of companies open business bank accounts through our leading bank partners in Ireland.

10. Licenses and Permits:

Depending on your business activities and NACE code, you may need to secure licenses or permits from relevant authorities. We help our clients file the appropriate licenses, too.

We have explained all the above steps in detail in our article Register a Company in Ireland: Step-by-Step Guide (2025). In the same article, we have also covered the post-registration compliance and obligations once a company is registered in ireland. Reach out to our team in case you have any more questions.

Our team can help you with your tax and accounting needs. Reach out to our team to discuss the process after your company is registered.

Here at Nathan Trust, we specialise in providing trusted solutions on all aspects of Company Law, Accounting, Tax, Company Secretarial Practice, and Corporate Governance, which allows you to plan, scale, and register your business in Ireland. With over 25 years of experience as company formation specialists and membership in Chartered Accountants Ireland, the Chartered Governance Institute, and the Irish Tax Institute, we are well-equipped to help you successfully launch your business in Ireland.

Please feel free to contact us below to register your company today.

The frequently asked questions (FAQS) on this page will provide you with an overview of some essential things you need to know when registering a company in Ireland as a foreigner.

Below is a short video of members at Nathan Trust discussing some of the top Irish company registration questions and other important requirements when setting up a company in Ireland from abroad.

HOW MUCH DOES IT COST TO SET UP A LIMITED COMPANY IN IRELAND?

When setting up a limited company in Ireland, we always try to provide a competitive quote tailored to your individual needs. We offer 2 types of company incorporation packages for our prospective clients:

(The fees below (ex-vat & outlay) would be enough to get your Irish company to a point where it can trade).

1. Standard Company Set-Up Package - costs €2795 (This is the basic requirement to register your company in Ireland legally).

2. Full-Service Company Set Up Package - costs €5680 (Full-Service package streamlines post-incorporation steps (like opening a business bank account and registering for tax/VAT), which are essential for trading but can be done separately if the client wishes).

What is included in the standard company setup package?

What is included in the bank and tax company setup package?

Reach out to our team today to get a clear breakdown of each service's fees under the packages and information on next steps.

HOW LONG DOES IT TAKE TO SET UP A LIMITED COMPANY IN IRELAND?

Setting up a limited company in Ireland typically takes 5 to 14 working days, depending on how quickly required documents are submitted and verified with the CRO.

Here's a breakdown of the timeline:

Step 1: Complete Anti-Money Laundering (AML) Checks (2–5 working days)

Before your company registration can begin, Irish law requires all directors and shareholders to pass Anti-Money Laundering (AML) checks. To complete this step, you’ll need to provide:

- 1 copy of a recent utility bill (dated within the last 3 months)

- If a company is the shareholder, Certificate of Incorporation and documentation identifying the Ultimate Beneficial Owner (UBO)

Completing this step efficiently helps avoid delays.

Step 2: Submit Signed Company Formation Documents (1–2 working days)

Once AML checks are cleared, we’ll prepare your company registration documents. These must be signed and returned to us to proceed.

Step 3: Company Registration with the CRO (Companies Registration Office) (3–5 working days)

After receiving all signed documents and passing AML checks, we file your application with the CRO. In most cases, the CRO processes company formations within 3 to 5 working days.

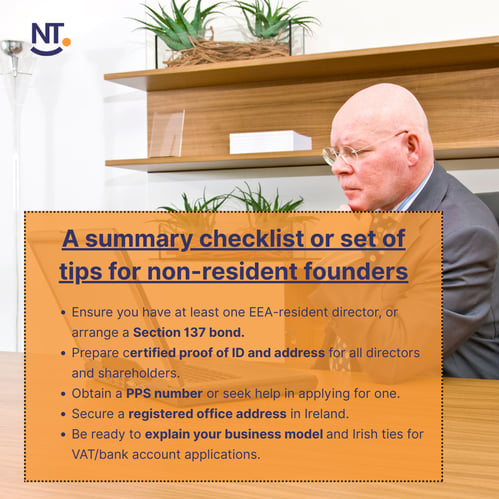

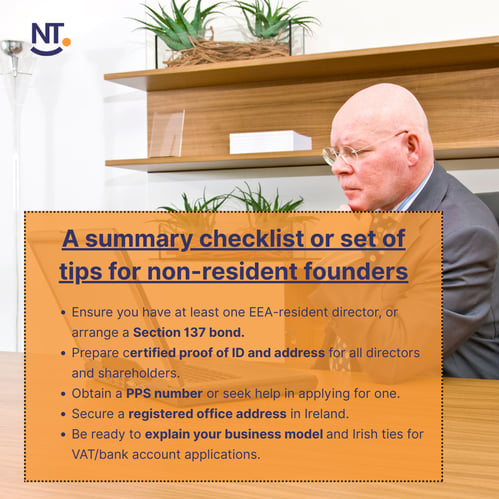

Do You Need a PPS Number?

Yes. A Personal Public Service (PPS) number is required for each director with more than a 15% shareholding. If you don’t have a PPS number, our team can assist you in applying for one.

The registration process brings several challenges in general. It's essential to plan your new Irish Limited Company setup journey right from the very beginning.

DO YOU NEED TO VISIT IRELAND TO SET UP A LIMITED COMPANY?

No, your physical presence is not required in Ireland in order to incorporate a company, but some banks may require an in-person meeting. Signed application and identity documents can be sent by post in advance of your limited company setup. However, we always like to invite our clients to Dublin or Cork to meet us where possible.

DO DIRECTORS NEED TO BE RESIDENT TO REGISTER A COMPANY IN IRELAND?

No, directors do not need to be residents of Ireland to register a company. However, Irish company law requires that at least one director must be a resident of the European Economic Area (EEA).

It's important to note that this requirement is based on residency, not nationality. For example, an Irish citizen living in the United States does not meet this requirement unless they also reside in an EEA country. In this case, they cannot be the sole director of the company.

While it's not a legal requirement, appointing a director who resides in Ireland is often recommended for tax residency purposes.

If your company does not have an EEA resident to fulfil the requirement of having an EEA resident Director, we can provide you with a Section 137 non-EEA Directors bond, You can also avail of a Nominee Director service for Irish company registration. We have a group of highly regarded professionals available to fulfil nominee director roles to ensure best practise in the compliance of your Irish Company.

WHAT TAX RATE WILL APPLY WHEN SETTING UP AN IRISH LIMITED COMPANY?

The corporate tax rate for a limited company in Ireland is currently 12.5%, among the lowest in Europe. The low corporation tax rate has been one of the primary reasons why companies globally are interested in Ireland. As Directors and business owners, it is very important to know the tax rates before proceeding with any decision related to your Irish company. It is a good opportunity for businesses to save a lot of money on their tax bills as well as ensure they get the most out of their year-end revenue.

You might be able to avail of the 3-year Tax exemption for Startup limited companies in Ireland.

A study by PWC - "Paying Taxes 2020" - ranked Ireland in first place for the ease of paying taxes. Ireland has double tax treaties (DTA) with 78 countries, 74 are in effect as seen on the Revenue website.

HERE’S WHAT OUR CUSTOMERS ARE SAYING ABOUT US!

Yuriy Andamasov, Co-founder and Chief Executive Officer at VyOS Inc.

We have worked with NathanTrust for more than two years (and don't plan to stop), and I can recommend Philip and his team to everyone who plans to do business in Ireland.

They are an exceptional multi-disciplinary team of professionals!

And to be more precise, here are just a few of the things they helped us with:

- company incorporation

- tax compliance

- legal compliance

- immigration topics

- real estate / rental matters

All the heavy lifting was done by NathanTrust, so for us at VyOS, it was almost effortless, and we could focus on other topics.

Our customers have rated our services 5/5 stars based on 35 reviews on Google reviews.

IS AN IRISH BUSINESS BANK ACCOUNT REQUIRED TO REGISTER A COMPANY?

No, an Irish business bank account is not legally required at the time of company incorporation. However, it is strongly recommended for practical and operational reasons.

Opening a local bank account is essential for:

- Register for taxes (VAT and PAYE)

- Managing day-to-day business transactions

- Processing payroll and supplier payments

- Establishing credibility with clients, partners, and authorities

Most companies in Ireland choose to open a business bank account immediately after incorporation to ensure smooth operations and full compliance.

CAN A NON-RESIDENT START A BUSINESS IN IRELAND?

Yes, a non-resident can start a company or business in Ireland. A lot of Irish companies have Directors who are not Irish residents. If the company does not have an EEA resident Director, then it needs a Non-EEA Directors Bond to be in place before the company can be set up. Please note that setting up a company in Ireland does not entitle you to Irish residency.

CAN YOU OPEN AN IRISH LIMITED COMPANY BANK ACCOUNT AS A NON-RESIDENT?

A non-resident director or shareholder can set up a business bank account in Ireland for an Irish limited company. Opening a business bank account as a non-resident can take longer and may require additional documentation. We work with 2 digital banks, Revolut and Fire. Both banks have the same guarantees as traditional banks about the protection of funds. They have excellent online banking facilities and the accounts can be opened in 1-2 weeks.

We also work with the 2 traditional banks in Ireland - AIB and Bank of Ireland. In our experience, these are the only 2 banks in Ireland that are set up to work with international companies just setting up in Ireland.

It is vital that you approach and engage with the banks in the right way, from day 1. We have successfully opened hundreds of Business Bank Accounts in Ireland for our clients globally.

HOW HARD IS IT TO GET VAT REGISTERED IN IRELAND?

Getting VAT registered for your company if you are a non-resident director and shareholder in Ireland is difficult. Irish Revenue requires evidence of real trading activity in Ireland to prevent fraudulent VAT registrations. Each document or proof requested is to demonstrate that your company will genuinely operate in Ireland, not just on paper.

You will need to show the following:

- You’ll need to show that your business is actively engaging with both Irish customers (those purchasing your goods or services) and Irish suppliers (companies or individuals you buy from). This could include draft contracts, letters of intent, invoices, or correspondence with Irish businesses

- 1-page business plan

- Irish phone number (you can get this via Skype)

- .ie web domain

- Possibly a short-term rental contract in a shared office space like this

https://www.republicofwork.com

This 2-minute 29-second video below explains in detail the VAT registration process in Ireland for a limited company. You can access the video on our YouTube channel too.

WHAT IDENTITY DOCUMENTS WILL YOU NEED WHEN SETTING UP A COMPANY IN IRELAND?

Before a company registration can be completed with Nathan Trust, you will need to furnish us with proof of identity (preferably passport) and a document showing proof of address (e.g. bank statements, utility bills, tax documents) for the directors and shareholders of the new company in Ireland. This is all part of the AMLD5 Directive from the EU.

ACCESS TO TALENT IN IRELAND

Ireland is renowned for its exceptional talent pool, making it one of the most attractive locations for businesses seeking a skilled and dynamic workforce. Here’s why Ireland stands out when it comes to access to talent.

As the European base for leading companies such as Google, Apple, and Pfizer, Ireland attracts top-tier talent from across the globe. The presence of these industry leaders creates a competitive and collaborative ecosystem, enriching the talent pool.

Ireland boasts one of the highest rates of third-level education attainment in Europe. The country's strong emphasis on education ensures a steady supply of qualified graduates across key industries, including technology, pharmaceuticals, engineering, and financial services.

The population is highly educated with 3rd level attainment among ages 30-44 of 55.4% vs the EU average of 40.3%. [Source: Central Statistics Office (CSO), Ireland]

The median age of the population is 38.8 years, indicating a relatively young demographic compared to other European nations.

With a median age below many other European countries, Ireland’s workforce is youthful, motivated, and tech-savvy. This demographic advantage fuels a dynamic employment market and a strong drive for growth and achievement.

British citizens can continue to travel, work and study in Ireland post-Brexit. The common travel agreement guarantees this and this is why a lot of people are moving to Ireland from the UK.

Ireland’s combination of a skilled, diverse, and future-ready workforce positions it as an ideal location for businesses seeking to thrive in a competitive global market.

HOW COMPETITIVE IS THE IRISH ECONOMY?

Ireland consistently ranks as one of the top countries in the world to do business in and consistently attracts a large level of foreign direct investment.

The Institute for Management Development (IMD)’s World Competitiveness Yearbook 2024 1 ranks Ireland as the most competitive country in the euro area and the 4th most competitive economy in the world (out of 67 economies).

(Source: National Competitiveness and Productivity Council Bulletin 24-4 IMD World Competitiveness Rankings)

With a workweek that typically does not exceed 40 hours per employee, Ireland has a high presence of multinational corporations that significantly enhance its labour productivity. Ireland ranks as the 2nd most productive country in the world as per the rankings here. Consequently, its GDP per capita has grown rapidly compared to other Western European nations.

Ireland witnessed an increase in average hourly labour costs, rising from €38 in 2022 to €40.2 in 2023.

NATHAN TRUST - FULL RANGE OF SERVICES

Our complete service offering combines a highly skilled and experienced team of Corporate Secretaries, Accounts and International Tax Specialists. We provide an 'end-to-end solution that supports all your Irish company compliance needs. From company setup to specialist tax advice to running your company payroll. We have it all covered. You can download our latest brochures detailing our services below:

DO LTD COMPANIES NEED TO HOLD ANNUAL GENERAL MEETINGS (AGMS) IN IRELAND?

Private Limited Companies (LTDs) may dispense with the requirement to hold an AGM provided members sign a written resolution dispensing with the AGM. If this option is not taken, then a company should hold an AGM each year, with not more than 15 months elapsing between AGMs.

If your company is required to hold an AGM, here are some practical tips on how to plan and conduct it successfully.

WHAT ANNUAL PAPERWORK NEEDS TO BE FILED FOR YOUR COMPANY IN IRELAND?

Every Irish company is legally required to file an Annual Return with the Companies Registration Office (CRO) at least once every calendar year, with the exception of the Company’s first Annual Return. This is a key compliance obligation, and failure to meet it can lead to serious penalties.

1. First Annual Return (AR01) – No Financial Statements Required

Your company’s first Annual Return Date (ARD) is exactly 6 months after the date of incorporation.

You have 56 days from the ARD to file the annual return.

2. Subsequent Annual Returns – Financial Statements Required

For all subsequent annual returns, you must submit a set of financial statements (company accounts) along with the return.

These financial statements must be made up to a date not more than 9 months before the annual return date.

3. Consequences of Missing Deadlines

If you miss the filing deadline, your company will face:

- Late filing penalties of up to €1,200

- Loss of audit exemption, meaning your company must undergo an annual audit for the next two financial years

4. How Nathan Trust Can Help

At Nathan Trust, we manage your Annual Return filing, including tracking your ARD deadlines, preparing and submitting financial statements, and ensuring compliance.

CAN YOU HAVE A SINGLE DIRECTOR COMPANY IN IRELAND?

Yes, a Private Company Limited by Shares (LTD) in Ireland can have a single director, but it must also have a separate company secretary. This is a key difference compared to other company types in Ireland, which typically require a minimum of two directors.

At Nathan Trust, we offer nominee company secretary services, which can fulfil this role for clients who want to set up a single-director/sole director company.

WHAT IS A COMPANY SECRETARY?

The Companies Act 2014 stipulates that every company must have a company secretary. As for their duties, the act states:

“The duties of the secretary of a company shall, without derogating from the secretary’s statutory and other legal duties, be such duties as are delegated to the secretary, from time to time, by the board of directors of the Company”.

These duties entail:

- Co-signing the annual return with one of the director(s) of the company.

- Maintaining the statutory registers of the company.

- Maintaining up to date minute books of meetings of the Board and the AGM.

- Ensure that all filings are made in the Companies Registration Office (CRO).

The company secretary does not have voting rights at board meetings and cannot make any board-level decisions unless the company secretary is also a director.

CAN ANYONE ACT AS A COMPANY SECRETARY?

Technically, yes, once they are 18 or over. There are no official educational requirements needed to act as Company Secretary, however, it is important to note that Irish company directors have a duty to ensure that the Company Secretary has the skills and resources necessary to discharge his or her duties. It is common for company directors to employ the services of a professional company secretarial firm. Nathan Trust offers the service of a professional nominee Company Secretary if you are interested.

CAN ANYONE SET UP A COMPANY IN IRELAND?

There are certain requirements for setting up a company in ireland. You must be at least 18 years old to serve as a director. Opening a company in Ireland is straightforward. Whether you are a resident or non-resident Director, you can register an Irish company with minimal barriers.

HOW MUCH IS COMPANY INCOME TAX IN IRELAND?

Company tax, otherwise known as corporation tax, is 12.5% in Ireland. This is one of the lowest corporation tax rate in the EU.

CAN ONE PERSON OPEN A LIMITED COMPANY IN IRELAND?

It is possible for one person to set up a limited company. When one person sets up a limited company in Ireland on their own, they will need someone else to act as the Company Secretary. You cannot act as both a single director and Company Secretary. Nathan Trust can provide a one-person, single-director company with a Company Secretary.

Many of our clients are single-member companies that use our Company Secretarial Services to meet their compliance requirements.

HOW DO YOU PAY YOURSELF FROM A LIMITED COMPANY IRELAND?

There are two main ways that you can pay yourself from an Irish company. You can take a salary from the company, or you can take dividends.

SETTING UP A COMPANY IN IRELAND AS A FOREIGNER

For those residing outside the EEA and non-residents, there are two options. You can purchase a non-EEA Director bond, which ensures the company is against fines for any offences under the Companies Act 2014, this bond would need to be renewed every 2 years. The other option would be for the Irish company to appoint a non-executive or “nominee” director to the board to satisfy the residency requirement.

Connecting with an expert can help you get started on the right foot! Let's schedule a discovery call and find out how we can provide what your company needs.

DO YOU NEED AN ADDRESS IN IRELAND?

Yes, all companies registered in Ireland must register with an Irish address, P.O box addresses are not permitted. This registered address does not need to be your trading address. Nathan Trust can provide your new Irish company with a registered address in Dublin or Cork.

WHAT SERVICES DOES NATHAN TRUST PROVIDE TO NON-RESIDENT COMPANIES?

At Nathan Trust, we provide a complete solution for company formation and corporate compliance, tailored to meet non-resident company's specific business needs in Ireland. Our team of skilled Corporate Secretaries, Accountants, and International Tax Specialists is here to support you at every step of the company setup process. From registering a limited company to opening an Irish bank account and ensuring full tax compliance, we deliver an end-to-end service backed by over 25 years of industry expertise.

Our services extend from providing specialist tax advice and managing payroll services to fulfilling all your Irish company compliance requirements. Whether you’re looking to register a new Irish company or expand an existing one, Nathan Trust ensures a seamless experience.

Download our latest brochures below to explore how we can support your business journey in Ireland.