Import-One-Stop-Shop (IOSS) Registration in Ireland

The new EU VAT Registration Rules for E-commerce for hassle-free customer experience.

Written by - David Bruton

Updated - 15/04/2024

Written by - David Bruton

Updated - 15/04/2024

The Import One-Stop-Shop (IOSS) is an electronic portal introduced by the EU in July 2021 that simplifies VAT declaration and payment on B2C sales of imported goods valued up to €150.

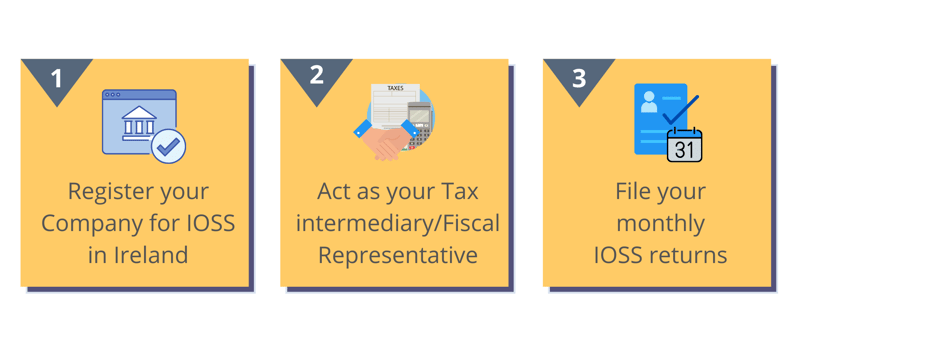

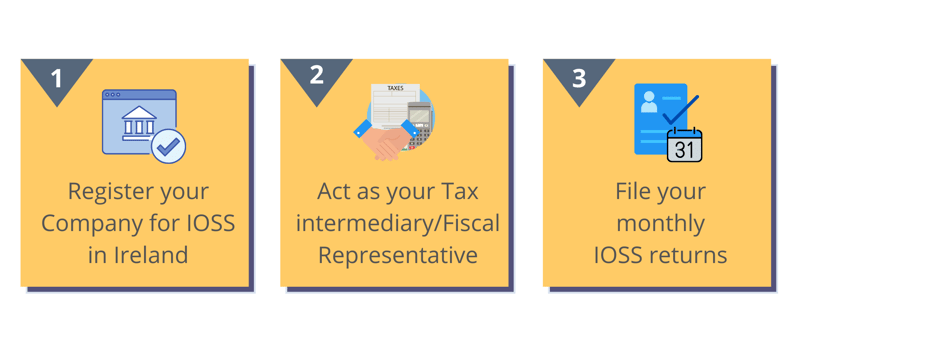

Nathan Trust's IOSS solution includes:

IOSS registration and identification number

Once you register, you can use your IOSS identification number for all shipments to the EU with a value of €150 or under

Monthly returns filing

Nathan Trust will file returns electronically through the IOSS portal of the Irish Tax authority.

Tax Intermediary services

Nathan Trust acts as your IOSS intermediary to complete registration and comply with EU requirements. This is compulsory.

See below a comparison table highlighting the advantages of using IOSS vs not using it:

| Aspect | With IOSS | Without IOSS |

| VAT Collection | At the point of sale | Collected from the customer at delivery |

| Customer Experience | Transparent pricing, no surprise charges | Additional VAT and handling fees at delivery |

| Customs Clearance | Faster processing | Potential delays and holds |

| Administrative Burden | Single monthly return | Possible multiple registrations |

| Returns Processing | Simplified | Complex VAT reclaim process |

Our pricing for the IOSS solution is as follows:

IOSS Registration in Ireland - €495 (one-time charge)

Monthly IOSS VAT Reporting - €1595 (charged annually)

Acting as your IOSS Intermediary - €895 (charged annually)

Prices for year 1 are €2,985 + VAT. Please note, if we are invoicing a company or sole trader resident outside the EU, then there will be zero VAT on the invoice.

Companies that are not established in the EU, or companies in a third country with which the EU has not concluded a VAT mutual assistance agreement, will need to appoint an intermediary to be able to use the import-one-stop-shop.

Do UK businesses need an intermediary for IOSS registration in Ireland? Yes. Following Brexit, UK businesses are considered non-EU businesses and must appoint an intermediary (fiscal representative) to register for IOSS in EU member states including Ireland.

The EU has VAT mutual assistance agreements with the following countries:

If your country is listed above, you do not need to appoint a tax intermediary in Ireland. This list is being updated on a regular basis.

Nathan Trust can act as your Fiscal Representative in Ireland.

If you are selling goods or products to consumers in the EU (B2C) and the consignment value is €150 or less, then you should register for an EU VAT number. This is also known as the Import One-Stop-Shop or IOSS.

If you do not have a company in the EU, then you can pick any EU country to register for an EU VAT number. UK companies need to have an EU VAT number too.

If you do not have an EU VAT number, then the customer will be liable to pay the VAT on the order before it is released from customs. This will likely delay the delivery of the goods and lead to unhappy customers.

We are experts at helping non-EU companies register for the IOSS in Ireland, We provide a full service EU VAT/IOSS solution.

If the consignment value of the goods is less than €150, this comes under the IOSS regime.

It is not relevant if the company is part of the EU or not.

Let's look at the following example:

Sofia from Germany orders a phone cover for €40 from a company based in the UK

The UK Co charges Sofia (€40 + 19%) because the VAT rate in Germany is 19%. The total invoice amount is €47.60

UK Co ships the product and it is delivered to Sofia without any delays a couple of days later. There is no customs duty on this transaction as the consignment value is less than €150.

UK Co is registered for IOSS in Ireland. So at the end of the month, the UK Co files its IOSS report and pays the VAT owed to the Irish tax authorities (Revenue).

Revenue then pay the VAT over to the German tax authorities

Note that non-EU businesses are required to appoint an intermediary to take advantage of the mechanism.

No, you do not need an EU company to register for IOSS in Ireland. We are working with a number of UK, US, Indian and Chinese companies helping them to register for IOSS in Ireland and manage their monthly IOSS returns.

This should only take 4 weeks but it can take longer. As a rule, we tell our clients that when working with government agencies, everything takes longer than you expect.

Sales with a consignment value of less than €150 are subject to IOSS but are exempt from Customs Duty.

As a result of Brexit, UK companies are no longer part of the EU VAT area for goods. UK companies that are supplying customers in the EU will need to register for IOSS in an EU member state.

The UK is a 3rd country like the US, China or India.

UK companies need to appoint a Tax Intermediary/Fiscal Representative. Nathan Trust provides this service.

Companies registered under the IOSS are not entitled to deduct any VAT expense incurred in any EU country. The IOSS is designed to facilitate the payment of VAT, not the reclaiming of VAT expenses.

Companies must retain detailed records of all transactions. This information must be retained for 10 years:

the Member State of consumption to which the services are supplied

the type of services supplied

the date of the supply of the services

the taxable amount indicating the currency used

any subsequent increase or reduction of the taxable amount

the VAT rate applied

the amount of VAT payable indicating the currency used

the date and amount of payments received

any payments on account received before the supply of the services

where an invoice is issued, the information contained on the invoice

in respect of services, the information used to determine the place where the customer is established or has his permanent address or usually resides.

If you are a UK company that needs to register for IOSS, then Ireland is the best choice because:

Ireland is the only English Speaking country in the EU

Similar tax & legal system to the UK

Similar business-friendly environment to that of the UK

Nathan Trust can act as your tax intermediary/fiscal representative.

Efficient processing times

Our service specifically addresses the unique challenges UK sellers face, including the mandatory requirement for fiscal representation that came into effect after the UK left the EU.

- Simplified VAT compliance for all 27 EU member states

- No VAT payment required by customers at delivery (improving customer experience)

- Faster customs clearance and reduced shipping delays

- Single monthly VAT return instead of multiple registrations

As a registered tax agent in Ireland, we provide the following services:

Register your Company for EU VAT/IOSS in Ireland

Act as your Tax intermediary/Fiscal Representative

File your monthly IOSS returns

We provide a full services solution for all your EU VAT/IOSS requirements.

Haley Bishop, Hygge Bands

Haley Bishop, Hygge Bands

"Super happy to have found Nathan Trust who helps with our EU tax (IOSS) needs. We were a bit lost with what to do but Nathan Trust made everything so simple from the beginning. Thanks!"