Virtual asset service providers (VASPs) operating in Ireland

Learn about registering as a VASP in Ireland, AML & KYC requirements, VASP services, and more.

Learn about registering as a VASP in Ireland, AML & KYC requirements, VASP services, and more.

.png?width=416&height=416&name=Untitled%20design%20(12).png)

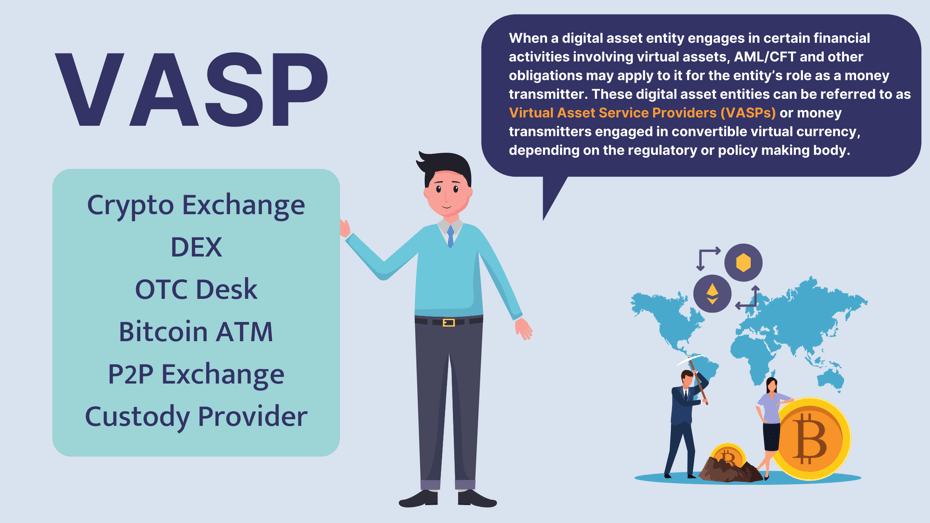

VASPs or VASP crypto are companies that provide services relating to the:

the exchange between virtual assets and fiat currencies;

exchange between one or more forms of virtual assets;

transfer of virtual assets, that is to say, to conduct a transaction on behalf of another person that moves a virtual asset from one virtual asset address or account to another;

custodian wallet provider; and

participation in, and provision of, financial services related to an issuer's offer or sale of a virtual asset or both.

In general, if your company is in any way related to the trading or holding of crypto assets, then you probably need to register as a VASP.

Yes, the company registering as a VASP can be a new Irish company. You do not need to have an Irish company to register in Ireland - but the application must be in English.

A virtual asset is “A digital representation of value that can be digitally traded or transferred and can be used for payment or investment purposes”

This includes:

This is based on the FATF standards and a full outline of this can be found here:

This is the most significant aspect of the application and the CBI will require detailed and robust answers here.

No, a VASP registration in Ireland will not passport VASP related services to any other EU country. If it wishes to sell services in other countries, it needs to register in these countries.

The European Commission proposed an authorisation regime for crypto-asset service providers, which would facilitate passporting. This is known as MiCA and is not expected to come into force until 2024.

The Central Bank of Ireland does not require a firm’s Compliance Officer (MLRO) to be located in Ireland. However, the Central Bank expect that applicant firms have a physical presence in Ireland and at least one employee in a senior management role located physically in Ireland.

The CBI have given clear guidance on what they consider a minimum requirement for pressence in Ireland for a VASP:

In line with the principle of territoriality enshrined in the EU AML Directives and Section 25 of the CJA 2010 to 2021, the Central Bank expects a physical presence located in Ireland and for there to be at least one employee in a senior management role located physically in Ireland, to act as the contact person for engagement with the Central Bank. In addition, the Central Bank may refuse an application where the applicant is so structured, or the business of the applicant is so organised, that the applicant is not capable of being regulated to the satisfaction of the Central Bank.

The Company should ensure that the MLRO:

Yes, VASPS are permitted to offer Anonymity-Enhanced Cryptocurrencies (AECs). The company should ensure they demonstrate an understanding of the risks associated with AECs and outline the controls the firm has in place to mitigate these risks – this should be reflected in the firm’s Risk Assessment, Policies and Procedures.

If you require any assistance with registering your company as a VASP, our company experts can help you set it up.

Contact our team below.

.png?width=661&height=359&name=Video%20img-01%20copy%201%20(1).png)

LEE JONES, FLUOROCHEM

"Working with Nathan Trust for our Irish company setup has been a positive experience. They helped us with everything, company setup, VAT registration and help with opening a Bank of Ireland bank account. Very responsive and great to deal with and they will continue to help us with accounting and bookkeeping in Ireland. Nathan Trust and Ireland are great options for any UK company looking to continue trading in the EU."