Ireland is the number 1 choice for foreign direct investment in 2021. So, it is not surprising that this is also the case for Web3 companies.

.png?width=1000&height=562&name=Add%20a%20subheading%20(7).png)

Top US Web3 companies with Irish subsidiaries:

-

Incorporated in July 2018, Coinbase has a growing team of 100+ full-time employees in Ireland. They have their EU head office in the IFSC in Dublin.

-

Incorporated in March 2018, ConsenSys has a growing team of 15+ full-time employees in Ireland.

-

Although Kraken has not incorporated in Ireland yet, they have a number of Irish employees and are building a strong presence here.

-

Binance has only recently incorporated their Irish company.

Why do Web3 companies choose Ireland?

Strong talent pool

Ireland is number 1 in the world for attracting and retaining talent. A lot of this talent consists of Web2 developers because Ireland is home to the top Web2 companies in the world.

There is a strong consensus that Web2 developers will transition to Web3 developers as these skills come into strong demand over the coming years. It is logical to assume that where there is currently a high degree of Web2 talent, there will be a lot of Web3 talent in the future.

There are already signs of a strong Web3 cluster of companies emerging in Ireland.

Ireland also has the youngest population in Europe, with one-third of the population under 25 years of age and nearly half the population under the age of 34. Nearly 10 per cent of workers based in Dublin work as software developers, according to Stack Overflow report 2017.

Despite Brexit, British citizens can continue to work, live and study in Ireland. Nathan Trust works closely with competent authorities on applying for employment permits and visas for workers from outside of the EU. There is one condition here for the critical skills application process. Please note that you will be required to have a ratio of 1:1 for Non-EU employees to EU employees. For example, if you plan to get a work permit for one Non-EU employee, you should have at least 1 EU based employee on the payroll. A part-time employee will be acceptable. We can help you source a part-time employee should you require assistance.

The continued success of Ireland’s FDI has resulted in a cluster effect for businesses as well as employees. This has resulted in Ireland having the fastest-growing tech worker population in Europe for 2017. The international share of the workforce is the 4th highest in the EU (17% in 2019). Source: CSO Labour Force Survey, Q3 2020; Eurostat, 2020.

Average Return on Investment

To start, the average return on investment for the companies that have invested in Ireland was the 5th highest in Europe, coming in at 11.7%. Ireland remains committed to increasing investment in productive capital assets, including key infrastructure.

Corporation tax - 12.5%

The corporation tax rate of 12.5% is undoubtedly an attraction to companies looking to relocate to Ireland. However, this is not the only incentive. Ireland has been ranked 1st in Europe for ease of paying taxes as per PwC "Paying Taxes 2020" report. There is a whole lot of other benefits that include R&D tax credit at 25% for qualifying R&D expenditure and an extensive tax treaty network.

Connected research

The Irish government has invested over $700 million in Research & Development (R&D). Ireland has a high level of collaboration between industry, academia, state agencies and regulatory authorities. Ireland ranked among the top 10 most innovative EU countries. Ireland also ranks among the top 15 most innovative countries in the world, including 1st for knowledge diffusion.

Ireland’s dynamic R&D sector is driven by an exceptional level of collaboration between industry, academia, state agencies and regulatory authorities.

Research Priority Areas 2018-2023, Ireland’s strategy for R&D, science and technology sets out priority areas across 6 themes. Source: European Innovation Scoreboard 2020; Global Innovation Index 2020; SFI Annual Report, 2019; DBEI, 2019.

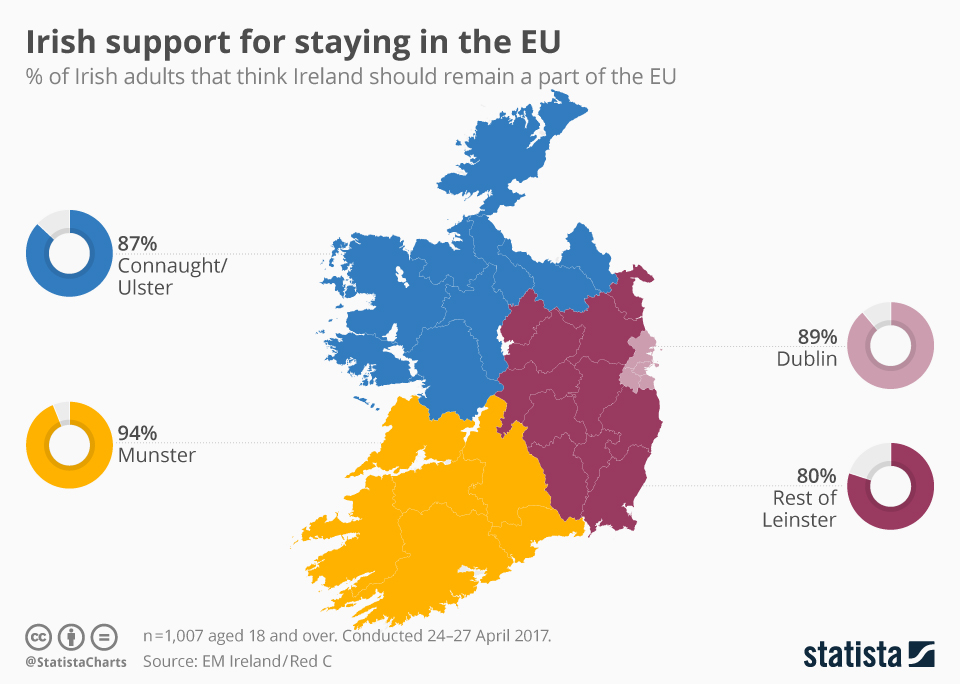

Ireland is Pro EU

For Web3 companies looking to access talent, the fact that Ireland remains a member of the EU is a huge bonus.

-

Ireland will remain a core member of the EU single market & Euro currency

-

Ireland is the only English speaking country in the Eurozone, post-Brexit

-

Ireland is most positive about the EU. 86% in favour of the free movement of EU citizens to live, work, study, do business in the EU (EU average 81%)

-

The international share of the total population is one of the highest in the EU (12.9% in 2020) There were over 400,000 international workers in the labour force in Q4 2020

If you are looking to set up a Web3 company in Ireland, get in contact with us below:

.png?width=260&height=170&name=Untitled%20design%20(1).png)

.svg)