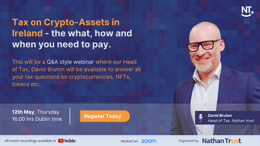

David Bruton

David is a Fellow of the Association of Chartered Certified Accountants and a Chartered Tax Advisor. In addition to dealing with ongoing accounting and tax compliance for clients, David’s areas of expertise also include personal and corporate tax planning, VAT and the international aspects of the Irish tax system. David enjoys trying to take the mystery out of tax for clients.

%20copy.jpg)

.png?width=260&height=170&name=Twitter%20Posts%20(30).png)

%20in%20Ireland.png?width=260&height=170&name=Private%20company%20limited%20by%20shares%20(LTD)%20in%20Ireland.png)

.png?width=661&height=359&name=Video%20img-01%20copy%201%20(1).png)

.svg)