The best EU country to establish your business depends on your specific needs. For example, businesses that are looking for a favourable tax regime may consider Ireland or Luxembourg. Businesses that require good infrastructure may want to consider Belgium or the Netherlands, or they may choose to have a company in a lower tax regime such as Ireland and establish a branch or subsidiary in countries such as the Netherlands or elsewhere in mainland Europe.

Firstly, let’s look at the benefits of having an EU company.

There are many benefits to having a company in the European Union. For businesses, the EU provides a single market with over 500 million consumers. This allows businesses to expand their customer base and reach new markets. The EU also provides a number of advantages for businesses, including:

-

A large market: The EU is the world's largest single market, with over 500 million consumers. This gives businesses the opportunity to expand their customer base and reach new markets.

-

Economic stability: The EU is one of the most stable economic regions in the world. This makes it an attractive place for businesses to invest and grow.

-

Access to finance: The EU provides access to a number of financial instruments, such as loans and venture capital, which can help businesses to launch and grow.

-

A skilled workforce: The EU has a large pool of skilled workers, making it an attractive destination for businesses looking to expand their workforce.

-

Favourable tax regime: The EU offers a number of tax advantages for businesses, including lower corporate tax rates and VAT exemption on exports.

The benefits of having an EU company are vast. By taking advantage of the opportunities that the EU provides, businesses can gain a competitive edge in the global marketplace positioning themselves for long-term success and sustainability.

Suggested read - Going global 2024: Top strategies to expand your business

Ultimately, the best European country to start a business in depends on the business's specific needs. Companies should carefully consider all of the factors before making a decision.

Factors to consider:

Market Access

One of the primary reasons that companies look to invest in countries outside of their home markets is to gain market access. A report from the Economist Intelligence Unit discovered that three in five, or 58%, of respondents highlighted market access as one of their top three motivations when starting operations in another country. Market access was prioritised over eight other factors;

Availability of key skills - 34%

Government incentives - 32%

Ease of doing business - 32%

Tax

The countries with the lowest corporate tax rates are Hungary (9%), Bulgaria (10%), Ireland (12.5%), and Luxemburg (15%), in that order.

- Double Tax Treaties

If you do not plan to relocate to the country and remain as a non-resident director/shareholder, there may be tax benefits available to you if your country of residence has a doubled tax treaty agreement with the country in which you plan to establish. Some countries have more double-tax treaty agreements than others. Ireland currently has 73 tax treaty agreements in effect with countries such as; the US, UK, China, Japan, Australia, Canada and many others.

If you do plan to relocate to Ireland there are several options for you to explore, such as Visas, Work Permits, Start-Up Entrepreneur Programmes, and Immigrant Investor Programmes.

Employees – Availability of key skills

Your company may require specialised skills and/or educated and trained employees. It is recommended that you check each country’s level of education. Ireland has one of the lowest rates of school leavers in the EU. In Ireland, 94% of all 20–24-year-olds had attained at least a higher secondary level of education. Ireland has one of the most educated workforces in the world. 52% of 25-34-year-olds in Ireland have a third-level qualification, compared to an OECD average of 43%.

Employee Pools

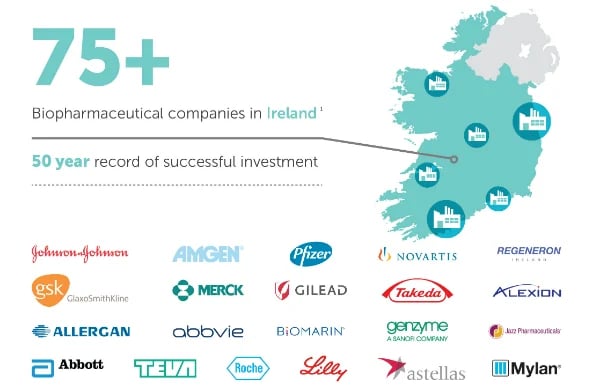

Employee Pools are usually generated by the presence of large multi-national companies in a country. Where you see multiple large multi-national companies, there is a high possibility that there is a pool of talented employees in the area or country.

Language

If you are unfamiliar with the language of the country in which you wish to incorporate, things can be a lot more difficult. If you find yourself in this situation, we highly recommend hiring a local firm and a translator. Having proficiency in the local language will save you a lot of time and help you avoid making major mistakes. Currently, Ireland is the only English-speaking country in the EU.

Government support & incentives

Most countries will offer some type of government support. The amount of support can vary greatly between countries. In Ireland, the two main providers of such support are the IDA and Enterprise Ireland. Both have very impressive portfolios of successful companies that have thrived in Ireland with their support. In terms of incentives, Ireland has a 3-year tax exemption for startup companies that can meet the criteria. Ireland also has some very impressive R&D tax relief grants.

Existing businesses/companies established in the country

Not only is the presence of large multinational companies a generator for employee talent pools, but they are also an indicator that the chosen country is a good place to do business. Ireland is a great example of this, it has large numbers of Tech companies and Pharmaceutical companies such as Google, Microsoft, Apple, IBM, Intel, Twitter, Facebook, LinkedIn, Pfizer, Lilly, MSD, Johson & Johnson, GSK, GE Healthcare, Janssen, and more.

Banking

As previously highlighted, an efficient banking system is essential. Having a mix of traditional banks and digital/online banks is a good option and is the case in the majority of EU countries. Before starting, it is important to check if that country facilitates business bank accounts for companies with non-resident directors/shareholders. It can be difficult to open a bank account as a non-resident in most countries. It is recommended that you use a trusted third-party professional services company or accountancy firm to assist you with the opening of the bank account.

Ease of doing business

The ease of doing business can vary from country to country across the world, and within the EU. Annual reports document each country’s position in terms of ease of doing business. You need to look at things like a country’s infrastructure, not just physical, but digital. Regardless of your industry or business, when you are choosing which country in the EU you need to ensure that it has efficient banking systems, internet/broadband coverage, healthcare, and government support. It’s worth bearing in mind that culture can also play a role in the ease of doing business.

A report by the World Bank ranked fourth in the EU for "ease of doing business.”

The World Bank’s Ease of Doing Business index has classified these into 10 parameters. These include:

-

Starting a business and paying taxes

-

Dealing with Construction Permits

-

Getting Electricity

-

Registering Property

-

Getting Credit

-

Protecting Minority Investors

-

Paying Taxes

-

Trading Across Borders

-

Enforcing Contract

-

Resolving Insolvency

Ireland is one of the top choices for companies looking to establish in the EU.

It is essential to examine all the above factors about the operation of your business. If you are looking for information on how to register a business in Ireland, the first step you need to take is to contact an experienced professional. Everyone’s situation is unique and it’s important to get your business off on the right foot.

If you would like to learn more, you can contact a member of our team using the form below:

.svg)